25+ kentucky wage calculator

52000 52 payrolls 1000. Hourly wage In Kentucky 725 is the.

Military Pay App Mobile Pay App Military Com

For example if an.

. Web Our Kentucky Paycheck Calculator is a fantastic help to learn how your hourly pay translates to weekly monthly or annual wages. Your average tax rate is 1167 and your marginal. Moreover for Tipped employees.

Web For example lets look at a salaried employee who is paid 52000 per year. If this employees pay frequency is weekly the calculation is. Web The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

Just enter the wages tax. After entering your information the calculator estimates the amount of your wage. Web Kentucky Wage Garnishment Calculator Estimate Garnishment Amount in 2 - 5 Minutes Expectations.

Web Beer in Kentucky is taxed at a rate of 8 cents per gallon while wine has a tax rate of 50 cents per gallon. In Kentucky overtime hours are any hours over 40 worked in a single week. Federal labor law requires overtime hours be paid at 15 times.

Well do the math for youall you. Web Kentucky follows has the same Minimum Wage rate as the Federal Minimum Wage of 725 for non-exempted employees. Web KY Minimum Wage Calculator Hourly Wage Rate.

Web Our wage garnishment calculator is a free tool available online. In 2018 Kentucky legislators. If youre a new employer youll pay a flat rate of 27.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky. Web How to calculate annual income. This free easy to use payroll calculator will calculate your take home pay.

If you make 70000 a year living in Kentucky you will be taxed 11493. Web Enter the percentage from section 2 b 1 of the Wage Garnishment Order may not exceed 15. Supports hourly salary income and.

The 2022 Kentucky State minimum wage rate is. Web Kentucky Paycheck Calculator. Unless youre in construction then your.

Estimated garnishment amount per paycheck Options to. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Web Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web Kentucky Income Tax Calculator 2022-2023. If the percentage is 15 enter 15 as a decimal. Web Kentucky Overtime Wage Calculator.

The Kentucky minimum wage is 725 per hour. Web The wage base is 11100 for 2023 and rates range from 03 to 9. Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week.

Web 23 rows Living Wage Calculation for Kentucky The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Saving And Spending Human Investing Blog Human Investing

Boone County Recorder 100313 By Enquirer Media Issuu

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Erg 2020 Pdf Economic Growth Unemployment

States Where Credit Scores Are Highest And Lowest

Kentucky Wage Calculator Minimum Wage Org

What Will Be The In Hand Salary Will I Be Getting Fishbowl

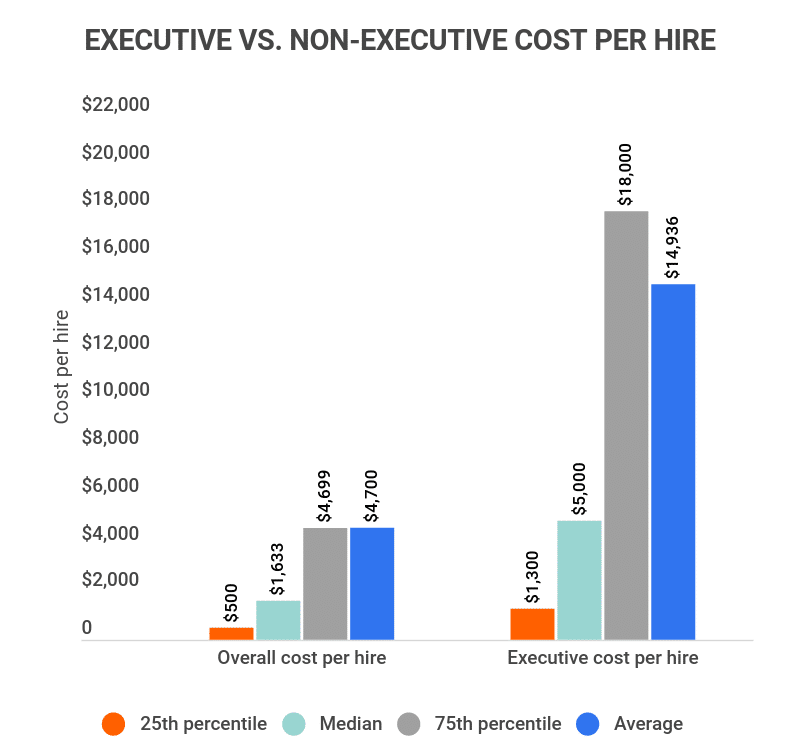

25 Crucial Average Cost Per Hire Facts 2023 All Cost Of Hiring Statistics Zippia

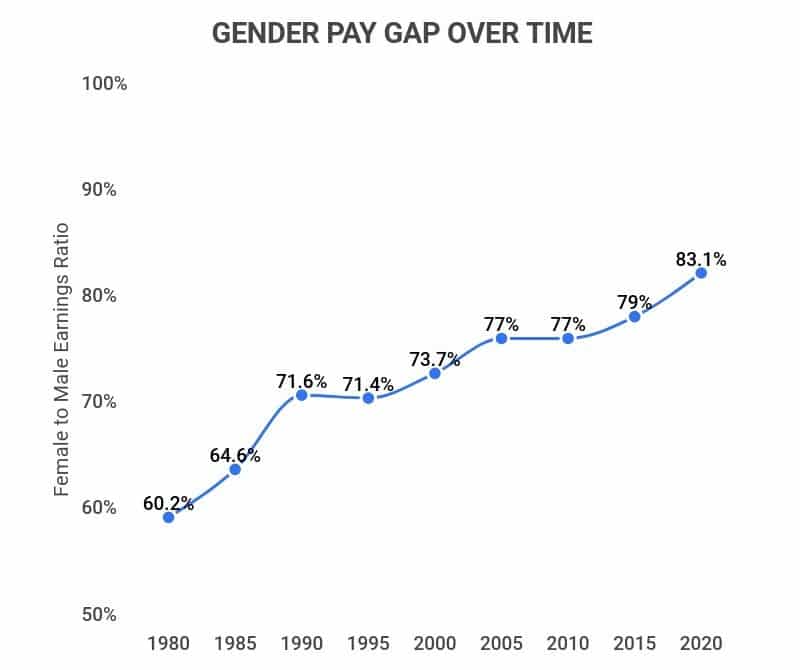

25 Troubling Gender Pay Gap Statistics 2023 Does The U S Have Equal Pay Zippia

Tax Preparation Checklist Get Your 2022 Tax Documents In Order

Blue Ribbon Commission On Tax Reform Office Of The Lt Governor

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Equivalent Salary Calculator By City Neil Kakkar

Kentucky Paycheck Calculator Tax Year 2023

Employee Paycheck Calculator Worker Take Home Pay Calculator

Kentucky Paycheck Calculator Smartasset

Pdf Spatial Dependence And Spatial Heterogeneity In The Effects Of Immigration On Home Values And Native Flight In Louisville Kentucky